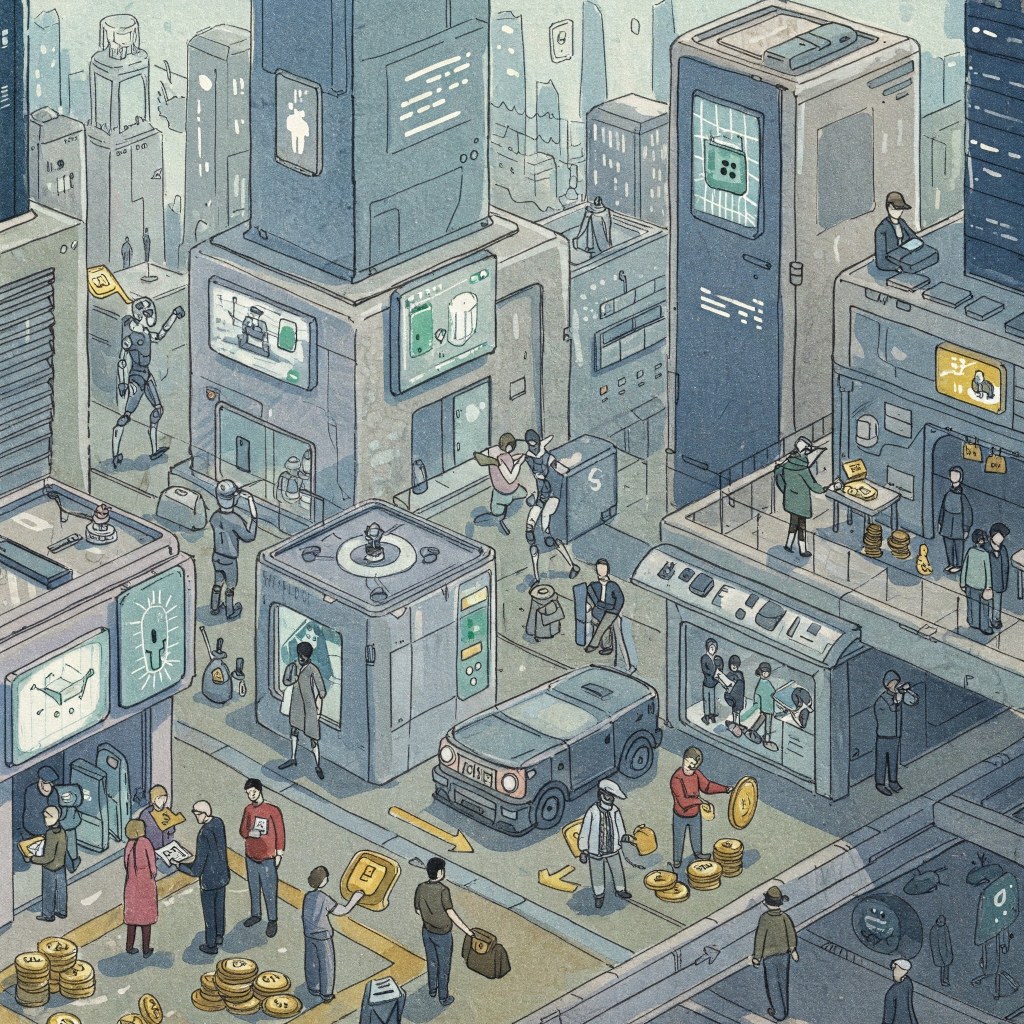

In the future, we’ll own a little bit of everything—and actually be happy: a vision beyond Klaus Schwab’s elite-centric utopia

In recent years, Klaus Schwab, the founder of the World Economic Forum, famously suggested that “you will own nothing and be happy,” a statement that has been widely criticized for its seemingly detached tone. Of course, Schwab did not intend for his words to be interpreted as an endorsement of a future devoid of individual ownership. However, the way it was received highlights an underlying tone-deafness—one that seems to permeate the thinking of the global elite. Schwab’s comment, while perhaps not as extreme as it first appears, reflects a disconnect between those at the top and the realities of everyday life for the majority. This essay, in contrast, proposes a different vision—Universal Ownership (UO)—where automation and technological progress can lead to a more equitable distribution of wealth, without the need for the patronizing and top-down control that Schwab’s vision suggests.

Universal ownership: a post-capitalist economic model

—

I. Introduction

The modern economic landscape is defined by a tension between wealth accumulation and equitable distribution. Traditional capitalism has enabled innovation, but it has also concentrated wealth among a few, fostering monopolies and increasing inequality. Governments have attempted to counterbalance these effects through taxation, redistribution programs, and social safety nets like Universal Basic Income (UBI). However, these measures often introduce inefficiencies, bureaucratic overhead, and dependency on centralized authorities.

Universal Ownership (UO) offers an alternative—an economic model that balances the benefits of free markets with a more equitable distribution of wealth. UO proposes that businesses, once profitable and operating with at least 90% automation, should transition to public ownership after 20 years. At that point, profits are distributed directly to citizens of the region where the business operates, removing the need for government intervention. Artisan businesses, which maintain human-driven production, remain privately owned indefinitely and are exempt from taxation.

This essay explores the mechanics of UO, its potential social and economic impacts, and the challenges it must overcome. By addressing these concerns, UO could serve as a viable alternative to traditional capitalism, fostering an economic system that aligns technological advancement with collective prosperity.

—

II. The Mechanics of Universal Ownership

Universal Ownership is based on a simple but transformative premise: businesses that achieve a high level of automation (90% or more) should transition from private to public ownership after 20 years. This mechanism is inspired by the logic of patent law, where inventors enjoy exclusive rights for a limited period before their creations become publicly accessible.

Transitioning Ownership

A company founded by an entrepreneur or investors begins with private ownership.

If the company becomes profitable and relies on at least 90% automation, the countdown to public ownership begins.

After 20 years, ownership transfers to the citizens of the region where the business operates.

Profits are distributed quarterly to all citizens in equal shares.

Automation Threshold and Artisan Enterprises

To differentiate between large, automated businesses and small-scale, human-driven enterprises, UO introduces an automation threshold.

Businesses operating with less than 90% automation remain private indefinitely.

These artisan enterprises are exempt from all taxation, allowing them to operate freely within the market.

This incentivizes entrepreneurship and preserves spaces for traditional craftsmanship and human labor.

This structure ensures that businesses employing large-scale automation contribute to societal wealth while smaller, human-driven enterprises retain their autonomy and flexibility.

—

III. Economic and Social Implications

The implementation of Universal Ownership could have profound effects on wealth distribution, market dynamics, and government structures.

Wealth Redistribution Without Bureaucracy

Unlike Universal Basic Income, which requires governments to collect and redistribute wealth, UO directly links profits to citizens. This eliminates bureaucratic inefficiencies and ensures that economic benefits flow organically from automation to the people.

Reduction of Monopolies and Economic Centralization

Since businesses transition to public ownership, monopolistic control diminishes over time.

Companies that dominate markets eventually become community-owned, preventing corporate power from concentrating indefinitely.

This natural cycle curtails excessive wealth accumulation by a few individuals.

Preservation of Market Incentives

Critics of wealth redistribution argue that removing financial incentives discourages entrepreneurship. UO maintains incentives by granting exclusive ownership for 20 years—long enough for founders to profit significantly. Additionally, artisan businesses remain private indefinitely, encouraging human-driven innovation.

Potential Shrinking of Government

With wealth redistribution occurring at the corporate level, the need for extensive government intervention diminishes. Welfare programs, social safety nets, and wealth taxes could be scaled down or eliminated, reducing government bureaucracy and inefficiencies.

—

IV. Challenges and Counterarguments

While Universal Ownership presents a compelling vision, several challenges must be addressed.

1. Preventing Exploitation of the System

One concern is that businesses might manipulate the system to avoid transitioning to public ownership. Possible loopholes include:

Artificially maintaining human employment to stay below the 90% automation threshold.

Corporate restructuring or rebranding every 20 years to reset the ownership timeline.

Solution:

Strict automation audits should assess workforce composition to prevent fraudulent classification.

Businesses that significantly alter their structure within the final five years before transition could be subject to review.

2. Managing Multinational Corporations

Many companies operate across multiple regions. If a business spans different countries, how should profits be distributed?

Solution:

A company’s profits could be allocated based on the percentage of revenue generated in each region.

A global treaty could standardize UO principles to ensure fair distribution internationally.

3. Long-Term Motivation for Founders and Investors

If businesses eventually become public, will investors and entrepreneurs still be motivated to innovate?

Solution:

The 20-year exclusivity period is sufficient for significant wealth accumulation.

A phased transition model, where founders retain a stake for an additional 5-10 years post-transfer, could incentivize long-term innovation.

4. AI and Ethical Business Management

With AI and automation running businesses post-transition, governance concerns arise. Who ensures that AI operates ethically and distributes profits fairly?

Solution:

AI management systems should be open-source and audited by independent regulatory bodies.

Ethical guidelines for AI-driven businesses must be established and enforced.

5. Addressing Wealth Gaps Between Nations

Smaller, wealthier nations may benefit more from UO than larger, developing countries with massive populations.

Solution:

A minimum baseline dividend could be introduced, ensuring citizens in developing regions receive equitable benefits.

International cooperation could redistribute excess corporate wealth globally.

6. Funding Government Services

With artisan businesses exempt from taxation and automated companies transitioning to public ownership, how will governments fund infrastructure and essential services?

Solution:

A small percentage (e.g., 5-10%) of dividends could be allocated to public infrastructure.

Governments could charge businesses a one-time transition fee upon reaching public ownership.

—

V. The Future of Universal Ownership

Universal Ownership is not a rigid doctrine but a conceptual framework that can evolve with societal needs. As automation continues to advance, economic structures must adapt to ensure prosperity is widely shared.

Potential Modifications and Enhancements

1. Gradual Ownership Transition: Instead of an abrupt shift at 20 years, ownership could phase into public hands incrementally.

2. Public Representation in Corporate Governance: Citizens could have a say in major business decisions through democratic mechanisms.

3. Integration with Blockchain and Smart Contracts: Transparent, automated dividend distribution could be ensured via blockchain technology.

A Vision for a More Equitable Economy

UO is not about dismantling capitalism but refining it. By linking automation-driven profits directly to citizens, UO prevents wealth from stagnating in the hands of a few while maintaining market efficiency. If implemented carefully, it could serve as a model for a fairer, post-capitalist economy—one where technology empowers everyone, not just the elite.

—

VI. Conclusion

Universal Ownership presents a radical yet pragmatic approach to economic reform. By transitioning highly automated businesses to public ownership after 20 years, UO balances innovation incentives with wealth distribution. Unlike UBI, which requires state intervention, UO allows economic benefits to flow naturally to citizens, reducing government dependence and bureaucracy.

While challenges exist—ranging from corporate restructuring loopholes to multinational profit allocation—solutions such as automation audits, global agreements, and phased transitions can address these concerns. Ultimately, UO provides a framework for a world where automation enhances prosperity rather than concentrating wealth.

As AI and robotics continue to reshape industries, societies must rethink economic models to ensure fairness and sustainability. Universal Ownership offers one such path—a vision where markets thrive, innovation persists, and prosperity is truly shared.